estate tax changes build back better

Tax provisions in the Build Back Better act Extending expanded earned income tax credit. Estate and Gift Tax Exemptions The Biden framework does not include lowering the current estate gift and generation skipping transfer GST tax exemptions before the previously scheduled sunset date of December 31 2025.

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Increased income taxes impacting fiduciary income taxes.

. House Bill Proposes Changes for Estate Planning Under the Build Back Better Act. An elimination in the step-up in basis at death which had been widely discussed as. Day Pitney Generations Newsletter.

Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026. None of the major provisions that would have affected estate planning were included in the House version. Surtax of 5 on the modified adjusted gross.

Notable aspects of the Biden framework for the Build Back Better Act that will affect estate planning include. As initially proposed the Act would have reduced the current 117 million basic exclusion amount BEA to approximately 6 million on January 1. This analysis was updated to contain the November 4th amended changes to the cap on the state and local tax SALT deduction.

If such proposal is adopted the resulting federal gift and estate tax exemption would reduce to just over 6 million as of January 1 2022. The bill would extend the changes to the earned income tax credit that were. President Bidens proposed Build Back Better Act includes major changes to estate and gift taxes to fund the social and education spending plan.

SIGNIFICANT ESTATE GIFT AND INCOME TAX CHANGES PROPOSED UNDER THE BUILD BACK BETTER ACT On September 13 2021 the House Ways and Means Committee released a proposed tax bill House proposal as part of the Biden administrations Build Back Better Act. The following surtaxes will be effective for tax years beginning on or after Dec. Tax Changes for Estates and Trusts in the Build Back Better Act BBBA The Build Back Better Act BBBA.

164 b limitation on the deduction for state and local taxes from. Trusts and estates lawyers and advisors have been keeping a close watch on recent developments regarding the tax proposals contained in HR. 5376 commonly known as the Build Back Better Act the.

The amended change would raise the cap to 80000 from 2021-2030 and revert back to 10000 for 2031. The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million indexed for inflation. The House Ways and Means Committee recently released its plan to pay for President Bidens proposed Build Back Better Act.

End Your Tax NightApre Now. 28 2021 version that followed the release by. 115-97 increase the limits on certain discounts of value for.

First the current USD117-million estate and gift tax exclusion was provided under a temporary clause of the Tax Cut and Jobs Act of 2017 and will be halved on 1 January 2026 even without any act of congress through the sunset provisions that remain in place. 3 2021 the House of Representatives released new draft legislative text updating the Oct. Gift and Estate Taxes Proposed Under the Build Back Better Act Lowering the gift and estate tax exemptions seems a lock.

While the Build Back Better Act provides a temporary reprieve for those with assets. Build Back Better Act and What the Changes to Gift and Estate Taxes Could Mean for Your Family Business. Heres what you need to know.

2022 Updates to Estate and Gift Taxes December 6 2021 The Build Back Better Act was passed by the House of Representatives on November 5 2021 and is headed for the Senate. Last month we sent a Client Alert about the Build Back Better Act the Proposed Act which contains tax law changes that would negatively impact numerous estate planning initiatives. 5376 would revise the estate and gift tax and treatment of trusts.

The Proposed Act includes a couple of proposals that would eliminate many of the benefits of irrevocable grantor trusts ie an irrevocable trust where the grantor. Ad 5 Best Tax Relief Companies of 2022. The proposal seeks to accelerate that reduction.

It would eliminate the temporary increase in exemptions enacted in the Tax Cuts and Jobs Act TCJA. November 5 2021. Most of the major proposals that would create substantial changes in the estate planning arena were not included.

Any modification to the federal estate tax rate. While the plan is still in negotiations and changes to the legislation are likely many of the. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

The House Ways and Means Committee recently released a draft of the tax changes proposed as part of the budget reconciliation bill to implement President Bidens social and education spending. The bill would increase the Sec. It remains at 40.

Senate Yet to Act December 3 2021 Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the Act which had been introduced in the House of Representatives. This preliminary analysis is still available here.

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

Us Treasury Pushes Back As Budget Office Warns Biden S Bill Will Swell Deficit As It Happened Us Politics The Guardian

/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 Definition

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

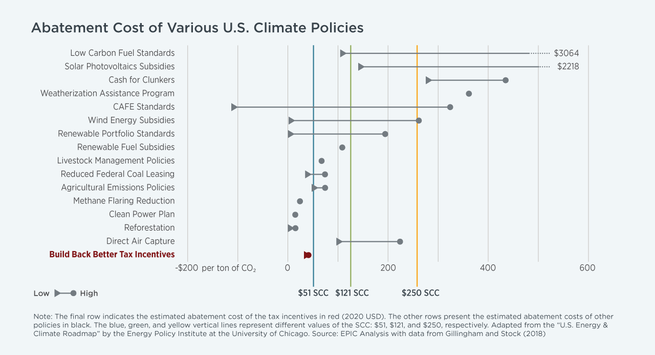

Biden S Biggest Idea On Climate Change Is Remarkably Cheap The Atlantic

What Are Marriage Penalties And Bonuses Tax Policy Center

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Biden S Big Social Spending Bill Probably Will Pass Senate This Month Without Many Cuts To It Analysts Say Marketwatch

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Biden S Bill Funds Niche Items From Electric Bikes To Tree Equity The New York Times

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation